How to Start a Venture Capital Firm and Form Fund I

Step-by-Step Blueprint for Starting a Venture Capital Firm and Raising Fund I

Starting a venture capital (VC) firm is an exciting, high-risk, and potentially high-reward business. Whether you’re an entrepreneur, experienced investor, or industry professional, launching your own VC firm can be both fulfilling and financially lucrative if done correctly. Here’s a guide on how to start your own VC firm and the steps involved in forming Fund I, the first venture capital fund for your firm.

1. Understand the Venture Capital Industry

Before embarking on the journey of starting a VC firm, it’s crucial to understand the venture capital ecosystem. This involves knowing:

The stages of startup funding: From seed rounds to Series A, B, and C.

Key investment terms: These include term sheets, valuation metrics, ownership structure, and exit strategies like IPOs and acquisitions.

Sector trends: Venture capital often focuses on specific industries like tech, healthcare, fintech, and biotech. It’s important to decide which sectors resonate with your expertise and interest.

Risk vs. reward: Venture capital is inherently risky. Not every investment will yield returns, but the successful ones can lead to outsized gains.

2. Create Your Investment Thesis

Your investment thesis forms the foundation of your VC firm’s strategy. It defines what types of startups you will invest in and why. Consider the following when developing your thesis:

Industry focus: Do you want to focus on a specific sector (e.g., software, green energy, artificial intelligence)?

Stage of investment: Will you be investing at the seed stage, early-stage (Series A), or later stages (Series B and beyond)?

Geographic focus: Are you targeting specific geographic regions, such as Silicon Valley, Europe, or emerging markets like Southeast Asia?

Social impact: Some VCs focus on companies with a strong social or environmental impact, like impact investing or sustainability.

A clear and focused thesis will not only help guide your investments but also attract the right limited partners (LPs) who align with your mission and goals.

3. Build Your Network

Networking is essential in the venture capital industry. Your network will help you:

Source deal flow: Access high-quality startups looking for funding.

Find co-investors: Other VCs, angel investors, and family offices that may want to partner with you on deals.

Secure advisors: Experienced industry experts who can provide advice and connections.

Raise funds: Attract limited partners (LPs) who will back your fund.

To build this network, attend startup events, venture capital conferences, and join entrepreneurial ecosystems. You can also leverage platforms like AngelList or LinkedIn.

4. Raise Capital for Fund I

Raising capital for your first venture capital fund (Fund I) is arguably the most challenging aspect of starting a VC firm. Fundraising involves attracting limited partners (LPs), who provide the capital for your investments in exchange for a share of the returns. Here are some ways to approach fundraising:

Target LPs: These are the individuals or institutions that will invest in your fund. LPs could include:

High-net-worth individuals (HNWIs)

Family offices

Institutional investors like pension funds, endowments, or foundations.

Corporates looking to invest in innovation.

Pitch your thesis: You’ll need to craft a compelling pitch to convince LPs of the potential returns and your ability to source and manage investments.

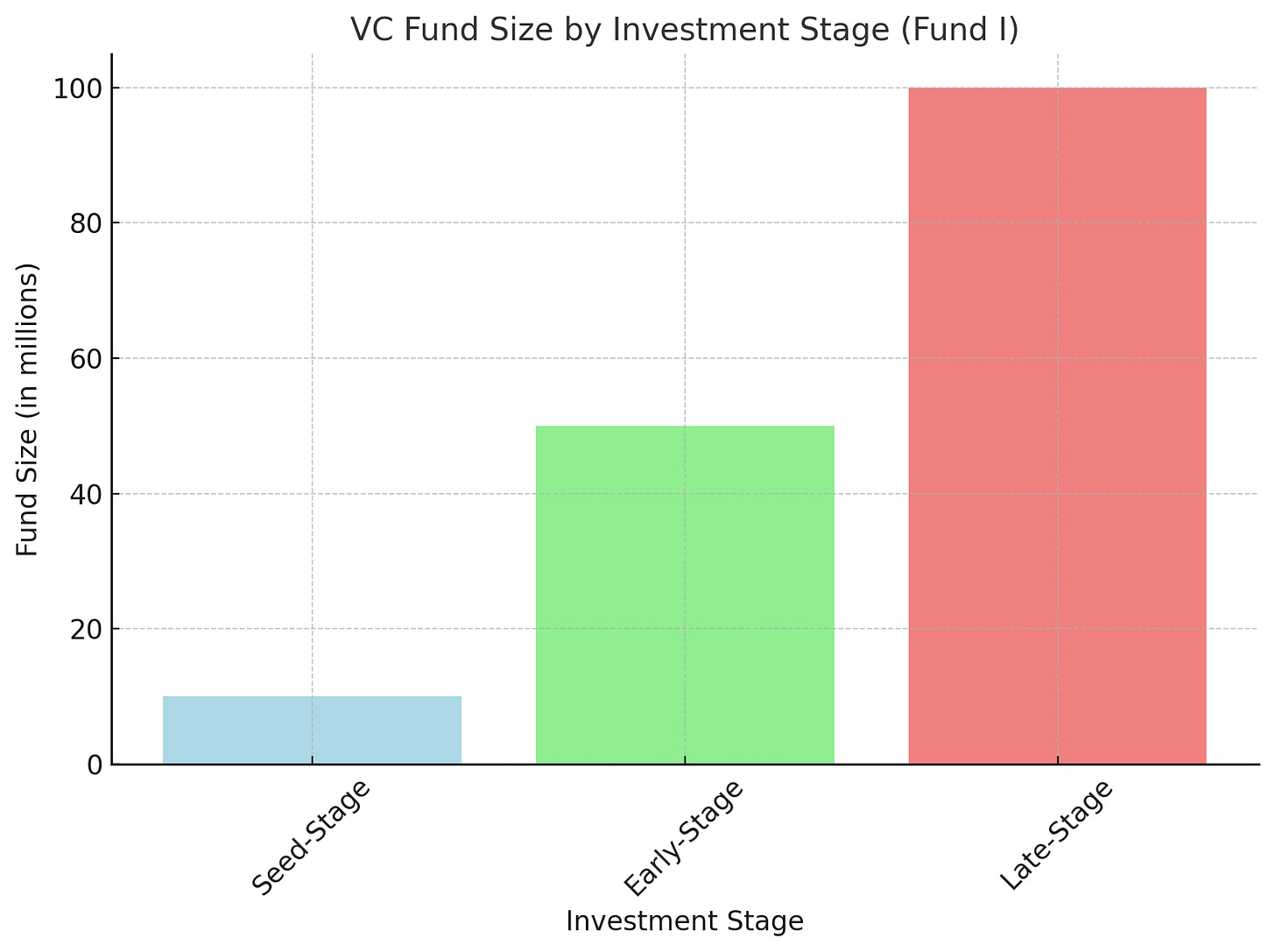

Size of Fund I: The amount of capital you aim to raise for your first fund is critical. Early-stage VC funds often raise between $10 million to $100 million for Fund I. The size depends on your track record, your network, and the types of companies you plan to invest in.

For example, if you’re targeting seed-stage investments, you may aim for a smaller fund size ($10M–$30M), whereas for Series A/B investments, you might aim for a larger fund size ($50M–$100M). Fund size also affects how many deals you can make, as early-stage VC firms usually make 15-25 investments in Fund I.

5. Set Up the Legal Structure of Your Firm

The legal and organizational structure of your firm is an important step. Most VC firms are set up as a Limited Partnership (LP):

General Partner (GP): The VC firm itself, which manages the fund and makes investment decisions.

Limited Partners (LPs): The investors in the fund who provide the capital but do not participate in day-to-day operations.

You will need to create a fund legal entity, draft partnership agreements, and establish the terms of the fund. The key terms in the partnership agreement often include:

Management Fees: Typically 2% annually, which covers operational costs.

Carried Interest: This is the share of the profits (usually 20%) that the GP receives after the LPs have received their initial investment back.

Fund Duration: The typical life of a VC fund is 10 years, with an option to extend for one or two more years.

6. Deal Sourcing and Due Diligence

Once you’ve raised capital for Fund I, it’s time to start sourcing deals. You’ll want to identify promising startups that fit within your investment thesis and provide long-term growth potential. This involves:

Sourcing deals: Build relationships with entrepreneurs, accelerators, incubators, and other investors to gain access to quality startups.

Due diligence: Perform rigorous analysis on the startup’s team, market opportunity, product, financials, and growth potential.

Investment decision: Based on your thesis and due diligence, decide which startups to invest in. Typically, a fund will make between 15-25 investments.

7. Investing and Portfolio Management

As the GP, you’ll make the investment and then work closely with the founders to help them grow their businesses. This might include:

Providing mentorship and strategic guidance.

Assisting with follow-on rounds and introductions to potential partners or clients.

Helping them navigate challenges, particularly as they scale.

VCs also often take a board seat or advisory role to provide oversight and support to the company’s leadership.

8. Exit Strategies and Reporting to LPs

Exits are how venture capitalists make money. These can occur via:

Initial Public Offerings (IPOs)

Acquisitions by other companies

Secondary sales (selling shares to other investors)

You’ll need to track and report the performance of your fund to LPs regularly, typically with quarterly updates and annual meetings.

9. How Much Can Fund I Raise?

The size of your first fund, Fund I, depends on a variety of factors, including:

Your experience: If you have a track record in successful investing or entrepreneurship, you may be able to raise a larger fund.

Your network: The strength of your relationships with potential LPs plays a big role in your ability to raise capital.

Your investment thesis: A focused and compelling investment thesis can help attract LPs who share your vision.

For Fund I, typical fundraising ranges from $10 million to $100 million. This size allows the fund to make between 15-25 investments, averaging $500,000 to $5 million per company, depending on the stage of investment and industry focus.

Final Thoughts

Starting a venture capital firm is no small feat, but it can be incredibly rewarding. With a clear investment thesis, a strong network, and the right strategy for raising funds, you can position yourself for success. Fundraising for Fund I is often the most challenging part, but once you’ve built your brand and reputation, it will be easier to raise future funds and make a meaningful impact in the world of startups.